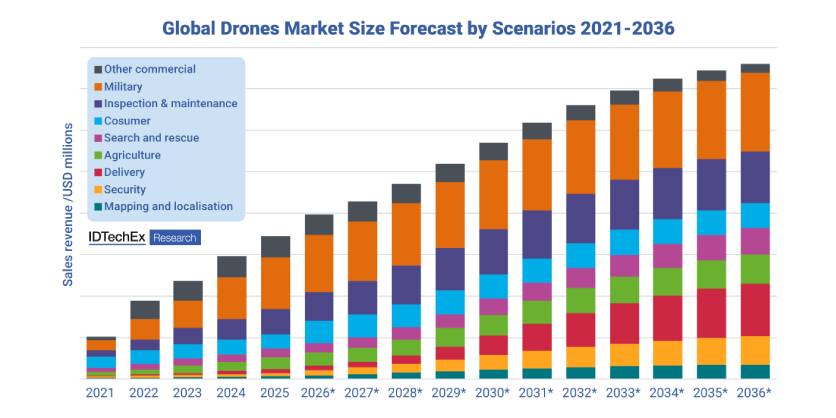

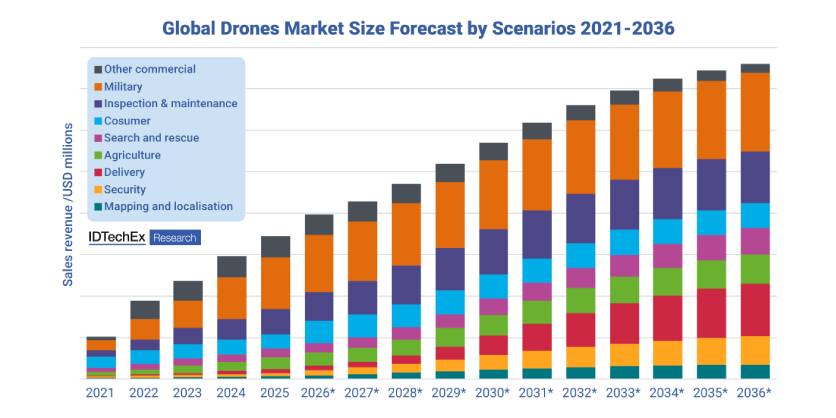

Global Drone Market to Reach More Than US$140 Billion by 2036 as Commercial Applications Scale, Finds New IDTechEx Report

December 12, 2025

Drones have transitioned from experimental tools into essential infrastructure across agriculture, logistics, energy, security, and public-sector operations. According to the newly released IDTechEx report “Drones Market 2026-2036: Technologies, Markets, and Opportunities“, the global drone market, including consumer, commercial, and defense platforms, is projected to grow from approximately US$69 billion in 2026 to US$147.8 billion by 2036, corresponding to a 7.9% CAGR.

This growth reflects accelerating commercial adoption, expanding regulatory approval pathways, and the emergence of autonomous, data-driven operations across multiple industries. While defense remains the largest revenue contributor, the commercial sector is experiencing the fastest structural transformation, supported by clearer regulations, falling hardware costs, and increasingly sophisticated sensor payloads. Commercial drone unit shipments are projected to exceed 9 million annually by 2036, underscoring the market’s shift from isolated deployments to scalable, repeatable workflows.

Commercial Applications Gain Momentum Across Agriculture, Inspection, Delivery, and Public Safety

Agriculture has rapidly entered the era of digital farming, particularly in China, the US, and Southeast Asia. By 2025, more than 30% of large farms worldwide are expected to use drones for tasks such as spraying, seeding, and crop monitoring. While multirotor drones dominate today, fixed-wing and hybrid VTOL platforms are expanding their presence in large-area mapping and long-range autonomous missions. Inspection and maintenance, spanning wind turbines, powerlines, pipelines, and industrial assets, is becoming the fastest-growing commercial segment.

Equipped with LiDAR, thermal cameras, and AI defect recognition, drones are displacing costly and hazardous manual inspections. From 2025 onward, operators are increasingly expected to adopt automated inspection workflows, including drone-in-a-box systems and cloud-based analytics, with the segment forecast to account for over 25% of commercial drone revenue by 2030.

Delivery drones are also transitioning from experimental trials toward regional commercialization. Companies across the US, Europe, and China are expanding both last-mile and mid-range logistics routes, aided by technology improvements in automated loading, cold-chain transport, and U-space/UTM integration. Public safety and security remain robust, with drones supporting surveillance, traffic monitoring, search and rescue, and emergency response. Meanwhile, the defense sector continues to dominate overall market revenue, driven by rising demand for reconnaissance drones, tactical platforms, and loitering munitions.

Regulatory Alignment and Sensor Proliferation Drive the Next Phase of Growth

Global drone regulation is converging toward harmonized, risk-based frameworks. The US (Part 107 and emerging Part 108/146), EU (C0-C6 classes and STS scenarios), UK (CAP722), and China have all established clearer pathways for commercial operations—particularly BVLOS, which will be central to long-range logistics and automated inspection networks. Key regulatory themes include altitude limitations around 120 meters, mandatory registration and pilot certification, stricter rules for BVLOS and operations over people, and digital authorization systems to manage airspace access.

At the same time, sensor proliferation is reshaping drone payload design. While commercial drone shipments are forecast to grow 2.3× from 2025 to 2036, sensor shipments will increase 4×, highlighting the shift toward higher-density, multi-sensor configurations. By 2036, many industrial drones are expected to integrate 10-15 sensors per platform, including multi-camera vision systems, high-performance LiDAR and radar, ultrasonic modules, barometric altimeters, and redundant IMUs for high-reliability missions. This increase in sensing capability enables greater autonomy, improved safety, and more complex mission profiles across commercial sectors.

These insights are part of the fully rebuilt IDTechEx report “Drones Market 2026-2036: Technologies, Markets, and Opportunities“, which provides a comprehensive market forecast, detailed platform and sensor analysis, and scenario-based evaluations across eight major commercial applications.

For more information on this report, including downloadable sample pages, please visit www.IDTechEx.com/DroneTech, or for the full portfolio of robotics-related research available from IDTechEx, see www.IDTechEx.com/Research/Robotics.